Projects

Project Portfolio Pipeline

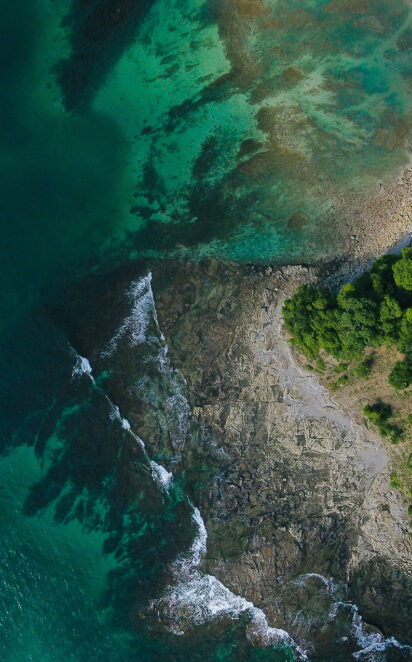

ORRAA’s Project Portfolio Pipeline identifies, accelerates and scales innovative finance and insurance products that invest into coastal and ocean natural capital in the Global South.

Projects are activated through Calls for Proposals, our Ocean Resilience Innovation Challenge (ORIC); and developed by and with coastal communities, members and partners.

The pipeline also supports the development of benchmarks and metrics to help measure and manage ocean risk; and produces science and research that informs ocean resilience solutions.

Financial Innovation Coast 4C

Policy and Governance WaterAid Nigeria

Lagos State Partnership for Coastal Resilience Initiative

Read more Financial Innovation Ocean Eye Inc.

Ocean Eye – Incentivising conservation through biodiversity-linked micropayments

Read more Financial Innovation Save The Waves

Developing Insurance Products for Surf Ecosystems and Surf Breaks

Read more Financial Innovation Fundación MarViva

Breaking the insurance barrier for vulnerable coastal populations in Central America

Read more Financial Innovation The University of Education, Winneba-Ghana